What Does Unicorn Finance Services Mean?

Table of ContentsThe Buzz on Unicorn Finance ServicesUnicorn Finance Services Can Be Fun For AnyoneEverything about Unicorn Finance ServicesHow Unicorn Finance Services can Save You Time, Stress, and Money.The 7-Minute Rule for Unicorn Finance ServicesExcitement About Unicorn Finance Services

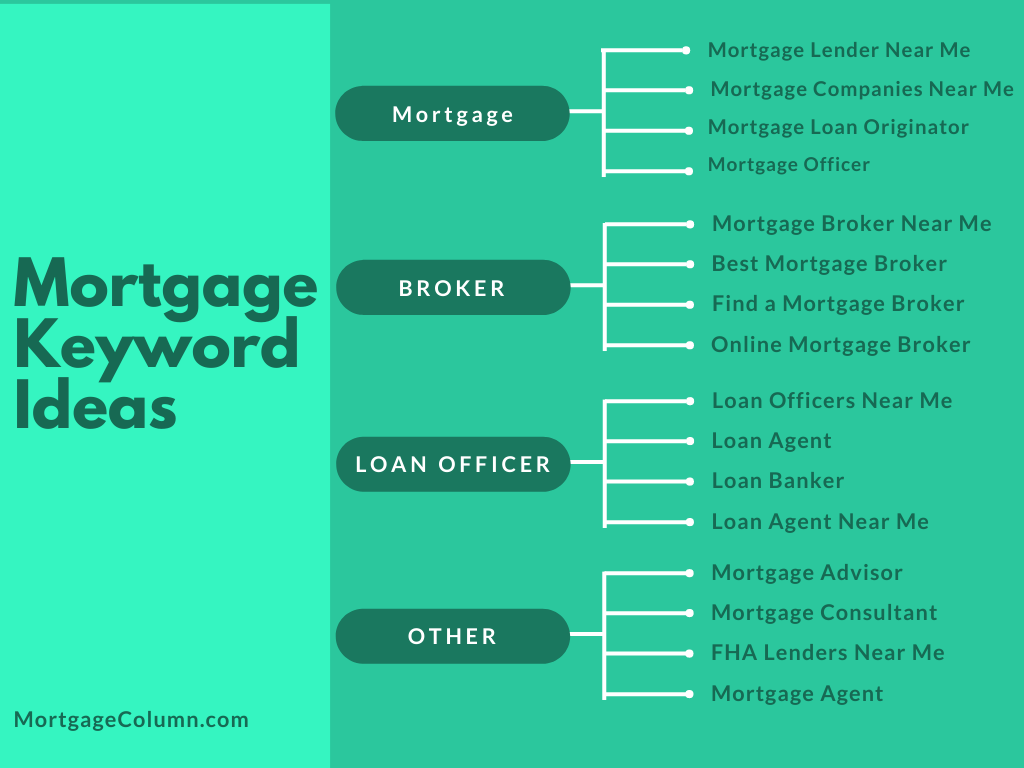

We independently examine all recommended products and services. Mortgage brokers assist potential consumers discover a lending institution with the best terms and rates to satisfy their economic requirements.

They also collect as well as verify every one of the essential paperwork that the lender needs from the borrower in order to finish the home acquisition. A home mortgage broker usually deals with various lenders and can use a variety of funding options to the debtor. A customer does not need to deal with a home loan broker.

Indicators on Unicorn Finance Services You Should Know

While a mortgage broker isn't required to help with the purchase, some lenders might only work through home loan brokers. If the loan provider you like is amongst those, you'll require to use a mortgage broker.

They'll respond to all questions, assist a consumer get pre-qualified for a loan, as well as aid with the application process. They can be your supporter as you work to shut the finance. Mortgage brokers don't supply the funds for fundings or approve funding applications. They aid individuals looking for home mortgage to locate a loan provider that can money their home purchase.

Then, ask pals, relatives, as well as business acquaintances for recommendations. Take a look at on the internet reviews as well as look for grievances. When conference possible brokers, obtain a feel for how much interest they have in helping you get the car loan you require. Ask regarding their experience, the exact help that they'll provide, the fees they bill, as well as just how they're paid (by lender or customer).

The Definitive Guide to Unicorn Finance Services

Right here are 6 benefits of using a mortgage broker. Home mortgage brokers are more versatile with their hrs and also often willing to do after hrs or weekend breaks, meeting at once as well as area that is hassle-free for you. This is a substantial benefit for complete time employees or family members with dedications to consider when intending to find an investment residential or commercial property or selling up and carrying on.

When you meet a home mortgage broker, you are successfully obtaining access to multiple banks and also their financing alternatives whereas a financial institution just has accessibility to what they are using which may not be matched to your needs. As a residential property financier, locate a skilled home loan broker that is concentrated on providing property investment finance.

Some Of Unicorn Finance Services

This permits it to end up being really free from what your borrowing power actually is as well as which loan providers are one of the most likely to lend to you. This assists you to identify which lenders your application is probably to be effective with and also decreases the chance that you'll be declined various times as well as marks versus your credit report.

Most brokers (however not all) generate income on compensations paid by the lending institution as well as will exclusively depend on this, offering you their solutions free of fee. Some brokers may gain a greater commission from a particular lender, in which they may be in favour of as well as lead you towards.

An excellent broker works with you to: Comprehend your needs and also goals. Locate options to match your circumstance. Use for a funding as well as take care of the procedure with to negotiation.

The Greatest Guide To Unicorn Finance Services

Some brokers obtain paid a basic charge no matter of what car loan they suggest. Other brokers get a greater fee for offering particular fundings.

Browse the following listings on ASIC Connect's Expert Registers: Credit Rating Rep Credit Licensee To look, choose the listing name in the 'Select Register' drop-down menu. If the broker isn't on among these lists, they are operating unlawfully. Before you see a broker, think of what issues most to you in a mortgage.

Make a checklist of your: 'must-haves' (can not do without) 'nice-to-haves' (can do without) See picking a residence financing for advice on what to think about. You can find a licensed mortgage broker via: a home mortgage broker expert association your loan provider or economic organization recommendations blog here from individuals you know Bring your listing of must-haves as well as nice-to-haves.

The Main Principles Of Unicorn Finance Services

Obtain them to describe exactly how each finance choice works, what it sets you back and why it remains in your benefits. You do not need to take the initial funding you're supplied. If you are not delighted with any option, ask the broker to find options. You might like a certain lender, such as your existing financial institution - https://sketchfab.com/unicornfinan1.

Comments on “Excitement About Unicorn Finance Services”